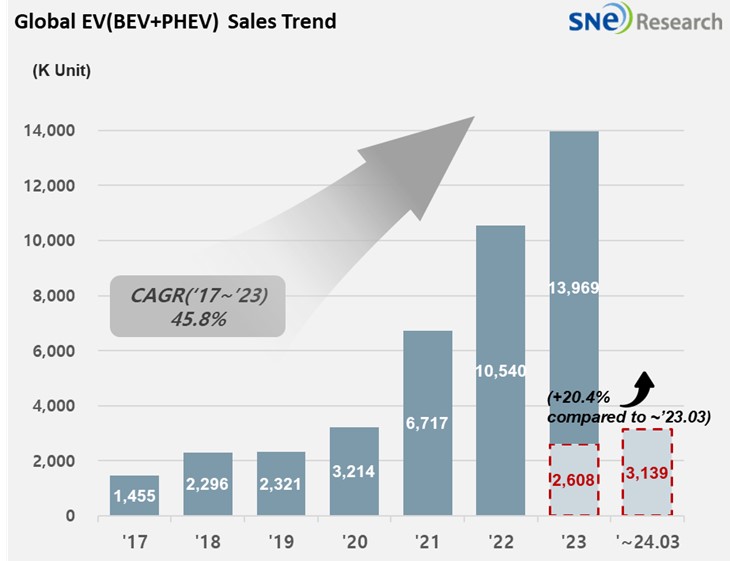

From Jan to Mar 2024, Global[1] Electric Vehicle Deliveries[2] Posted Approx. 3.139 Mil Units, a 20.4% YoY Growth

- BYD maintained its top place; Tesla posted a degrowth

From

January to March 2024, the number of electric vehicles registered in countries

around the world was approximately 3.139 million units, a 20.4% YoY increase.

(Source: Global EV and Battery Monthly Tracker – April 2024, SNE Research)

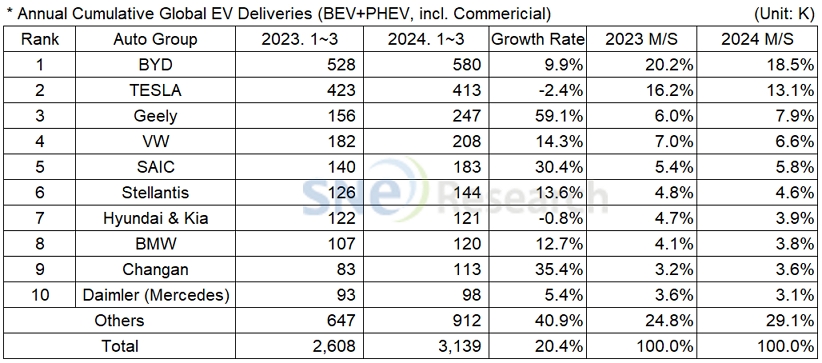

If we look at the global EV sales by major OEMs from Jan to Mar 2024, the leading EV maker in China, BYD posted a 9.9% YoY growth but still maintained its top place in the global market. BYD’s growth was led by favorable sales of Song(宋), Seagull (海鸥), and Dolphin (海豚). BYD gradually expanded its market share with a broad range of options offered to customers by providing various segments and having sub-brands like Denza(腾势) and Yangwang(仰望). It seems that BYD’s performance in Q1 2024 was slower than expected as the competition for price reduction in the Chinese domestic market has gotten fiercer. The number of BYD’s BEV sold, excluding PHEV, was approximately 290k units.

Tesla ranked 2nd, posting a 2.4% YoY degrowth with reduced sales of line-ups other than Model Y. Tesla pointed out several reasons for such sales reduction in Q1 as follows: production issues faced during the initial stage of Model 3 Highland at the Fremont Factory in the US; delivery delays due to the Red Sea crisis; and the shutdown of Berlin gigafactory due to after arson attack. Elon Musk, CEO of Tesla, announced, “The production of new, low-cost model, initially expected to start in the 2nd half of 2025, will begin no later than early next year.” The new, low-cost model, regarded as a new ‘cash cow’ to boost the sales of Tesla, has drawn a great attention from the market.

The 3rd place was captured by Geely Group. Its light EV model, Panda (熊猫) MINI saw more than 23k units sold, and Volvo’s new EV, EX30, has been increasingly popular mainly in Europe. The Group launched sub-brands such as Galaxy (银河), ZEEKR (极氪), and LYNK & CO (领克) to target the mind/high-end vehicle markets by add diversity to its portfolio.

(Source: Global EV and Battery Monthly Tracker – April 2024, SNE Research)

Hyundai-KIA Group posted a 0.8% YoY degrowth. It was the result of declining sales of IONIQ 5/6 and EV6, but the global sales of new KONA Electric (SX2 EV) and EV9 has expanded, and the overseas sales of Tucson and Sportage PHEV has increased, instead. KIA announced that it has a plan to keep the momentum by successfully launching EV6 facelift and EV3 new model in the latter half of this year. By expanding the line-ups in its EV-dedicated brand, IONIQ, and maximizing the sales through the optimization of production and sales, Hyundai Motors seems to focus on increasing its share in the green car market which is forecasted to continue to grow in the mid- and long-term

(Source: Global EV and Battery Monthly Tracker – April 2024, SNE Research)

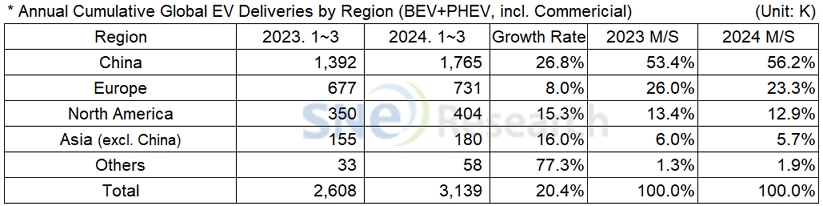

By region, China firmly captured the top position as the world’s biggest EV market, accounting for 56.2% of the entire market share. Due to the Chinese New Year holidays in February, the growth in China slowed down temporarily, but it came back to the upward trajectory with a massive growth. Unlike the beginning of last year when the EV sales dropped because of the termination of subsidy policy, electric vehicles have been popularized in earnest among the Chinese consumers. It is based on several factors as follows: the increasing sales of light EVs equipped with price competitiveness, the expansion of customer options with the launch of sub-brands by major OEMs, and the China’s New Energy Vehicle (NEV) mandate policy.

Europe took up 23.3% of the global EV deliveries. Europe used to see a high growth in the EV market mainly driven by BEV in the past, but due to a slowdown in demand for EV, the growth of BEV in Europe was found to be significantly dropping. The penetration rate of BEV in Europe got lower, and there have been growing pressures about possible declines in profits due to penalty imposed on OEMs in Europe. Given these, the regulations stipulated by Euro 7 have alleviated and they are even postponed to a later date, implying that EVs are actually hitting speed bumps in Europe.

In North America, the growth of EV market was mainly led by the sales of Tesla, Stellantis, and Hyundai-Kia. However, the sales of EV in North America, where the upward trend in the EV market has sustained thanks to the IRA, has been gradually slowing down since the latter part of 2023. with the next presidential election scheduled at the end of this year, the Biden administration has been revising and reviewing its plan to strengthen the emission regulations as part of slowing down the transition to electric vehicles. Former US president, Donald Trump, rebuked the green policy by the incumbent government and expressed his opinion that the US should focus more on vehicles with internal combustion engine.

It seems that the BEV market, which had enjoyed a rapid growth since 2021, started to see a slowdown in demand since the end of 2023. With the EV penetration rate stalled, major OEMs and battery makers, realizing the slowdown in demand, announced to postpone or revoke their investment plans. In addition, consumers hesitate to choose electric vehicles in fear of high electric vehicle price and lack of charging infrastructure compared to rapidly-growing electric vehicles. All of these lead to a temporary slowdown in demand for electric vehicles, which, however, is expected to rebound and, in mid-to-long term, the trend of electrification is forecasted to continue. Although the regulations on ICE vehicles were relaxed in Europe, the ban on new ICE vehicles in line with the carbon neutrality policy is still valid. Given the current and projected demand in the car market, PHEV and HEV are not enough to cope with demand while the ICE vehicle ban is imposed. Also, continuous declines in battery pack price are expected to contribute to maintaining the profit of OEMs.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period